Boosted Board, the California startup that popularized electric skateboarding and helped to bring electric skateboarding to the mainstream is failing.

How did this hugely popular electric skateboard company that raised over $70 million dollars fall this far? And will another popular California based startup called Future Motion, the makers of the Onewheel, follow a similar fate?

That’s what I’m going to explain in this article.

Venture Capital 101

To understand the fall of Boosted, you have to understand how the venture capital business model which fuels much of the modern tech industry works, so let me give you the Cliffs notes version of Venture Capital:

- A start up company raises a bunch of money from investors.

- The company uses that money to grow.

- More funding and money comes pouring in during more rounds of funding from more investors as the company grows.

- With more money comes intense pressure to continue growing no matter the cost.

- As VC investors look for a home run on their investment, they push for supernatural and hyperfast growth instead of organic and natural growth.

The only real options for a company that has taken significant VC money at this point is to eventually:

Option 1. go public

Option 2. to sell

Option 3. The least desirable but the most common… go broke.

Option 4. For companies that take a reasonable amount of Venture Capital money, they may have the option to grow organically.

Now that we have an elementary understanding of the nature of venture backed startups, let’s look at the demise of Boosted and then compare that to what the makers of the Onewheel are up to.

As a disclaimer, I have no insider knowledge into any of these companies. Everything I’m sharing with you I have curated from the world wide web and my understanding of business as taught to me from the show Shark Tank.

Boosted Boards, A Brief History

Boosted Board started in 2012. Through clever marketing and help of a popular youtuber named Casey Neistat, Boosted Boards quickly became synonymous with electric skateboards.

During this time micromobility became a hot thing for Venture capitalists to invest in (think rental electric scooter companies) and electric skateboards seemed like it was on the verge of going mainstream in America.

Boosted raised about $75 million dollars from investors, most recently was a $60 million dollar round at the end of 2018. Yet here we are, just a little over a year later with the company unable to pay their debts, having to lay off much of their staff, and looking for a buyer. So what happened?

Who’s to Blame?

You can blame increased competition such as the flood of cheap chinese knock off electric skateboards. People love to blame the Chinese.

You can blame Trump and his tariffs. People love to blame Trump. I just don’t see how tarriffs would affect Boosted more than any other company that relies on China for the production of their products. Also, almost all the electric skateboards on the market are made in China. While some of these other e-skate businesses have failed, why hasn’t the tariffs killed all of these companies?

You can blame Boosted’s poor management. Despite their name recognition, the product was mediocre compared to the growing competition while still maintaining a premium price point.

But what I think played the biggest part of the fall of Boosted was the huge amount of Venture Capital money that they raised.

How can raising $75 million dollars be a bad thing?! Let me explain.

Too Much Venture Capital Money Can Kill a Start Up

Once you take that VC money, don’t think that there aren’t strings attached because there are a lot of strings attached. Investors expect a return on their investments and the more money that is invested, the higher the expectation of a home run.

Here are reasons why venture capital money is bad:

- VCs push startups to grow fast at all costs.

- Small problems don’t get fixed until they become big ones.

- Insisting on growth can mean sacrificing profitability.

- They push founders to sacrifice a viable present for an improbable future.

- A win for VC isn’t necessarily one for the startup.

So instead of being a little mom and pop shop focusing on natural growth through a solid business model, there were huge expectations for almost impossible growth at no matter the cost.

This intense pressure often leads to poor decisions and waste. It pushes companies to grow too fast and to move into markets or areas that they are unprepared for, all in search of growth with the expectation to go public on the stock market or to sell to a bigger company.

In Boosted’s case, because they were so beholden to their investors, instead of focusing on their product, the electric skateboard, and profitability, they ventured into scooters in search of growth.

It reminded me of a quote from the show Silicon Valley…

[The company’s] product is its stock. Whatever makes the value of the stock go up is what we are going to make.

Jack Barker

And that’s what Boosted did. They bet on an already crowded e-scooter market as a source of growth and now they can’t even pay off their distributors despite having raised $75 million dollars.

What will happen to Boosted?

What are their options at this point? Once you’ve taken that amount of VC money, remember, your options are to Go public, Sell, or Go Broke.

Because the niche of electric skateboarding isn’t big enough to go public on the stock market, that only leaves two options. Sell or go broke. As of writing this article, Boosted is actively searching for a buyer however that will be hard given the amount of debt they are likely to be in.

I hope Boosted doesn’t go broke. They have a following, a brand name, and an infrastructure that is worth something so I see them eventually being purchased by a Chinese company looking to expand in the US market.

While the price tag may be too high even for rich Chinese companies, you never know. Segway, once knighted the future of transportation, sold themselves to a Ninebot, a Chinese company and now they make scooters and some hover chair thingys.

The rise and fall of Boosted saddens me. But what happened to Boosted is an all too common story when it comes to the world of Venture Capital.

Is Future Motion and the Onewheel Next?

Now let’s briefly look at Future Motion, the makers of the Onewheel. Will they follow the same path as Boosted?

Let’s do a little digging.

On December 2015, Future Motion filed form D with the SEC after raising money with investors.

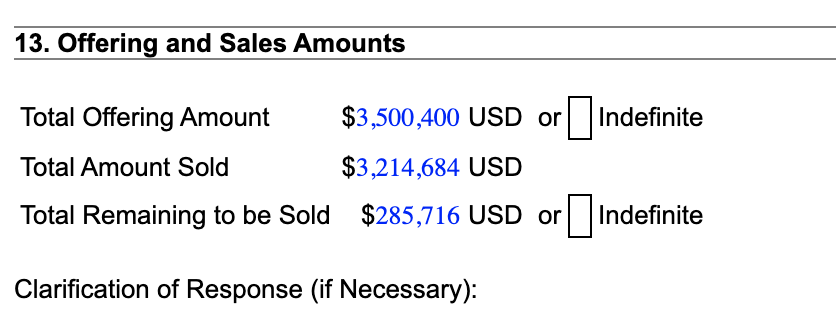

Look here on Line 13 and you’ll see that they hoped to raise $3.5 million and ended up raising $3.2 million from investors.

So we know they have investors involved. Who are the investors? Well, there are 3 according to Crunchbase. One of whom is the senior VP of marketing at GoPro. That’s cool. I’m not familiar with any of the other two investors.

How much stake do these investors own? We don’t know that but I’d guess around 20% because it makes for nice clean numbers. For all you Shark Tank fans, that means in 2015/2016, 20% of Future Motion sold for $3.2 million so the valuation of the company at the time of sale was by my guestamation, $16 million.

So what does this all mean? Well, $3.2 million is a lot of money, but it’s a lot less than what Boosted took and that means a lot less pressure for Future Motion to always shoot for the moon and succeed.

Also, from what we can find, FM hasn’t raised any more money for the last 4 years so maybe this means that they don’t need outside money to grow and they are going for more of an organic growth strategy.

But they do have investors, 3 of them, to which they are beholden. Maybe these folks like the GoPro guy, are like minded folks who want to see the company succeed and not just to give up the farm just to grow and eventually sell. Who knows. All I do know is that investors are always looking for a return.

The Onewheel is a niche product and the micromobility market is still a small market. I don’t see Onewheel ever going public because of this. So the other two options for FM are to sell or go broke.

I hope FM doesn’t go broke. I love their product. But if their next product is a scooter, then we should all be prepared for the worst. I just can’t see that happening.

So the only option left is to sell. That would be the only way to appease the investors and I’m sure there are more than a few rich Chinese companies that would love to get hold of FMs patents so they can enter the US market and flood it with Onewheels and all the variations you can think of.

Sounds like a nightmare but would that be so bad? Maybe. But I could definitely see the Chinese making the Onewheel at lower costs and improving the distribution of the Onewheel on a larger scale around the world making it easier and cheaper to buy a Onewheel in places like Europe, Asia, and Australia which would be pretty amazing. Let’s just hope the batteries don’t catch fire.

Conclusion

I know I’ve painted venture capital poorly in this video so I have to say that VC has brought us some incredible companies like Google, Facebook, Snapchat, and Uber.

Unfortunately not all companies are made for Venture Capital money as we can see from the story of Boosted.

I’m Jimmy Chang. I love riding my electric mobility devices like my Onewheels and EUC and I love talking about it. If you found anything of benefit from this article, help me out and subscribe to my newsletter for future content on all things related to the electric movement.